Adani Group Stocks Soar: Are Investors in for a Long Ride?

Adani Group stocks have seen a meteoric rise in recent months, making headlines and filling investors’ pockets. But the question on everyone’s mind is: will this upward trajectory continue?

Growth and Profite story of Adani Group Stocks: Bullish Momentum Continues!

Adani Enterprise;-

- Adani Enterprise Stock Price are experiencing a period of sustained growth, with several companies reaching all-time highs and others showing promising breakout patterns.

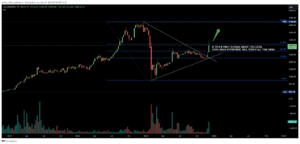

current price of Adani enterprise on chart showing 2897 if the stock price sustain above 3160, with analysts predicting a further surge to reach a target price of ₹4200.

image source: trading view Adani Power ;-

Adani Power is currently trading at an all-time high of ₹556, with analysts predicting a further surge to reach a target price of ₹730. The chart indicates a strong upward trend.

Image Source: Trading view Adani Green Energy ;-

- Adani Green Energy, having recovered for over a year, has witnessed a trendline breakout this week. This breakout suggests potential future price targets of ₹1750, ₹2060, and even ₹3056.

Image Source: Trading view weekly chart Adani Port;-

- Adani Ports is also demonstrating recovery, with a bullish trendline breakout accompanied by a strong candle this week. If the price stays above ₹986, the next target price is anticipated to be ₹1576.

Image Source Trading view - These bullish signals across several Adani Group companies indicate a positive outlook for their stock performance in the near future. Investors should conduct their own research and consult with financial advisors before making any investment decisions.

Here are some Adani group Stocks key takeaways:

- Adani Power: Current price ₹556, potential target price ₹730.

- Adani Green Energy: Trendline breakout, potential target prices ₹1750, ₹2060, ₹3056.

- Adani Ports: Trendline breakout, potential target price ₹1576.

- Overall, Adani Group stocks are showing positive momentum.

- Disclaimer: This information does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. Strong financial performance, backed by robust demand for products and services, is one of the key drivers behind this surge. (Image of a graph illustrating Adani Group’s financial performance)

- Additionally, the group’s focus on infrastructure development, particularly in ports, airports, and power plants, is seen as a major catalyst for long-term growth. (Image of Adani Group infrastructure projects)

Uncertainties Ahead of Adani Group stocks :

- While the short-term outlook appears promising, predicting the future of any stock market can be tricky.

- The Indian economy’s health plays a crucial role, and a potential slowdown could impact demand for Adani Group offerings.

- Government policy shifts, particularly those affecting the infrastructure sector, are another factor to consider.

- Competition within the infrastructure space from other giants like Reliance Industries and Larsen & Toubro is another element to watch.

- Global economic conditions, including interest rates and inflation, can also influence the Adani Group’s stock performance.Investing Wisely:

- While the Adani Group’s stock rally seems likely to continue in the near future, investors should approach cautiously.

- A thorough understanding of the risks involved, including economic fluctuations, policy changes, and competition, is crucial before making any investment decisions.

- Staying informed about the latest developments within the Adani Group and the broader market landscape is essential for navigating the ever-changing investment environment.

The Future of Adani Group Stocks:

Adani’s Ascent: Stock Surge Propels Him to India’s Second Richest ,Whether the Adani Group’s stock rally continues its upward climb or faces a temporary setback, one thing is certain: the company’s ambitious growth plans and significant investments in key sectors position it for long-term success. By staying informed and making informed decisions, investors can potentially reap the rewards of this dynamic and growing group.

Adani Power Share Price FAQs:

Q: What is the current stock price of Adani Power ?

A: As of today, Thursday, December 7, 2023, at 11:16 IST, Adani Power is trading at ₹560.25. This represents a 0.05% decrease from its previous closing price of ₹560.55.

Q: What is the market capitalization of Adani Power stock?

A: The current market capitalization of Adani Power is ₹216,085.00 Cr.

Q: What is the 52-week high and low for Adani Power ?

A: The 52-week high for Adani Power is ₹589.30, while the 52-week low is ₹132.55.

Q: Is Adani Power a good stock to invest in?

A: This is a complex question and depends on your individual investment goals and risk tolerance. However, here are some key metrics that can be used to evaluate Adani Power stock:

- TTM P/E:26

- Sector P/E:70

- Dividend Yield:00%

- Debt/Equity Ratio:80

- Net Profit (2023):₹10,726.64 Cr

It is important to conduct your own research and consult with a financial advisor before making any investment decisions in stock market.

Q: Is Adani Power stock profitable?

A: Yes, Adani Power stock reported a net profit of ₹10,726.64 Cr in 2023.

Additional Information:

- This information is accurate as of Thursday, December 7, 2023, at 11:16 IST.

- The stock market is volatile, and the price of Adani Power can fluctuate significantly in the short term.

- It is important to stay up-to-date on the latest news and developments affecting the company before making any investment decisions.