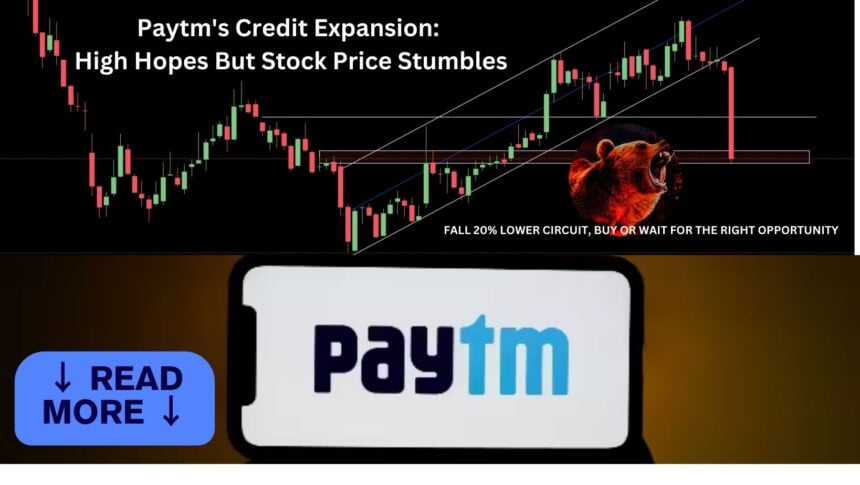

Paytm’s Credit Expansion: High Hopes But Stock Price Stumbles

Paytm, India’s leading digital payments and financial services company, recently announced a significant expansion of its credit distribution business.

This strategic move aimed to focus on offering high-value loans for both consumers and merchants, in partnership with established banks and NBFCs. However,

the news surprisingly led to a 20% drop in Paytm’s stock price.

Paytm’s Credit Expansion Goals and Details:

- Paytm, previously focused on smaller loans, intended to cater to a wider range of credit needs by offering larger personal loans, merchant loans, and business loans.

- This expansion involved partnering with leading banks and NBFCs to leverage their expertise and risk management capabilities.

- The goal was to offer more competitive interest rates and longer loan tenures, making larger loans more accessible to Paytm’s vast user base.

Paytm’s Credit Expansion Reasons for Stock Price Fall:

- While Paytm’s expansion plans seem ambitious and potentially promising, the 20% drop in stock price indicates investor concerns.

- Some analysts speculate that the move towards higher ticket loans could lead to increased non-performing assets (NPAs), impacting Paytm’s profitability.

- Additionally, concerns remain regarding the company’s ability to effectively manage credit risk in a highly competitive market.

Investor Skepticism and Market Dynamics:

- Paytm’s past performance has been mixed, with some quarters showing impressive growth and others falling short of expectations.

- Investors are cautious and may be waiting for concrete evidence of the success of Paytm’s credit expansion strategy before investing further.

- The Indian credit market is intensely competitive, with established players like HDFC Bank and Bajaj Finserv already dominating the high-value loan segment.

Future Outlook and Potential Impact:

- Paytm’s success in this venture depends on its ability to attract high-quality borrowers, manage risk effectively, and offer competitive rates.

- If successful, this expansion could significantly boost Paytm’s revenue and profitability, solidifying its position in the Indian financial landscape.

- However, failure to manage credit risk effectively could lead to further financial losses and damage investor confidence.

Overall, Paytm’s expansion into high-value loans is a bold move with significant potential benefits and risks. Only time will tell if this strategy will propel the company towards greater success or lead to additional challenges.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.